Flexible Packaging Market by Packaging Type (Pouches, Bags, Roll Stock, Films & Wraps), Printing Technology (Flexography, Rotogravure, Digital Printing), End-user Industry, Material (Paper, Plastic, Metal) and Region - Global Forecast to 2027

Flexible Packaging Market

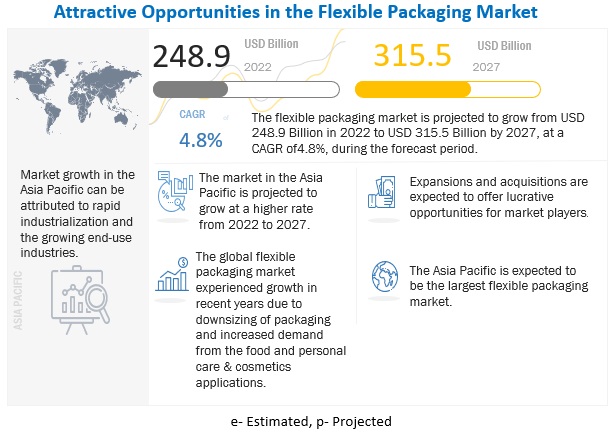

The global flexible packaging market size was valued at USD 248.9 billion in 2022 and is projected to reach USD 315.5 billion by 2027, growing at 4.8% cagr during the forecast period. Flexible packaging is a method of packaging goods in a more affordable and adaptable way by using materials that aren't rigid in nature. It is a relatively new technique in the packaging industry, but it has gained popularity because of its great effectiveness and low cost. A wide variety of flexible packaging products, such as pouches, bags, sachets, roll stocks, wraps, and others, are produced from a variety of flexible raw materials such as metal, plastic, and paper. Industries that require versatile packaging, like the food and beverage, personal care, and pharmaceutical sectors, can benefit greatly from flexible packaging.

To know about the assumptions considered for the study, Request for Free Sample Report

Flexible Packaging Market Dynamics

Driver: The rising demand for flexible packaging in the food and beverage sector drives the market.

The population of the twenty-first century has a strong preference for packaging that is both practical and cost-effective. People are choosing to eat prepared meals that are served in flexible packaging and pouches due to growing urbanization, busy work schedules, and the need to arrive on time. As a result of this, more food businesses are thinking about using flexible packaging for their goods. Packaging industry leaders are doing this by engaging in strategic activities like mergers and acquisitions, product developments, investments, and facility expansions that help them in advancing their goal of providing adequate solutions for their consumers in a cost-effective way.

Restraint: High cost of flexible packaging raw material and unavailability of good recycling infrastructure

The prices of raw materials such as plastic, paper, and metals, which are used for producing various flexible packaging products, are nowadays on the higher side. Additionally, due to a lack of supply, the cost of polypropylene, which is used in resins, bottles, and packaging films, has increased. The competitiveness of businesses in the flexible packaging sector has been impacted by this circumstance.

There is a non-availability of a closed-loop system that is used to handle the recycling of flexible packaging products, especially those which are made from multi-layer high-barrier materials. However, recycling multi-layered flexible packaging products involves more steps as compared to traditional packaging. In addition to this, the recycling process of flexible packaging products is a time-consuming and energy-intensive process, which requires a good recycling infrastructure.

Read more: Flexible Plastic Packaging Market Report

Opportunities: Growing demand for sustainable packaging

Brands are now putting a lot of effort into finding ways to lower their carbon footprint due to increased concern about their environmental impact. The Paris Agreement, a binding agreement on climate change, was unveiled in 2015 to aid in limiting global warming to 2 degrees. With a commercial commitment to reducing their emissions, several nations have now made a commitment to this cause by setting net-zero targets. Currently, many manufacturers focus on providing sustainable packaging solutions to consumers by optimizing the packaging materials and using the right packaging materials to make things smaller and lighter, reducing the need for transportation.

Increasing awareness regarding hygiene is the major key factor that drives the market for flexible packaging.

Challenges: Rapid changes in the technology

Formats, designs, and trends in flexible packaging are always changing along with technological possibilities. The packaging industry has acknowledged the need for smart packaging to enable inventory management, sales tracking, product tracking, intelligent storage, and other functions with less manual labor. As a result of the rapid change in technology, the existing flexible products have become outdated now. In addition to this, many manufacturers want to attract more consumers by offering appealing or attractive packaging solutions that fuel the varying needs of consumers.

Flexible Packaging Market Ecosystem

To know about the assumptions considered for the study, download the pdf brochure

By End Use Industry, the Food industry accounted for the highest CAGR during the forecast period

In the food industry, the increasing concern about hygiene and sustainability, rising urbanization, changing lifestyles, and high disposable income are the major factors that drive the market of flexible packaging. Customers want their food products to be both hygienic and safe, as well as appealing to the eye. Manufacturers have a very strong ecosystem for food service packaging. They are constantly inventing to ensure that the consumer benefits, and they have a specialized R&D house that conducts numerous research-based tests employing the most recent technologies. However, due to the other favorable properties of flexible packagings, such as excellent barrier properties, it can be made using fewer resources, increases the product shelf life, and many more, which attract consumers mainly from the food industry.

By Packaging Type, the Pouches segment accounted for the highest CAGR during the forecast period

Pouches are small bags comprising two side flat sheets that are flexible and sealed along the edges to form a compartment whose volume is dependent on the relative position of the walls. There are mainly two types of pouches: stand-up pouches (SUPs) and flat or pillow pouches. The two types of stand-up pouches are standard stand-up pouches and retort stand-up pouches.

Pouches are ideal for bulk coffee packaging and food items such as dried or smoked meats. They are easy to use, heat sealable, and available in convenient packaging with multiple sizes and formats.

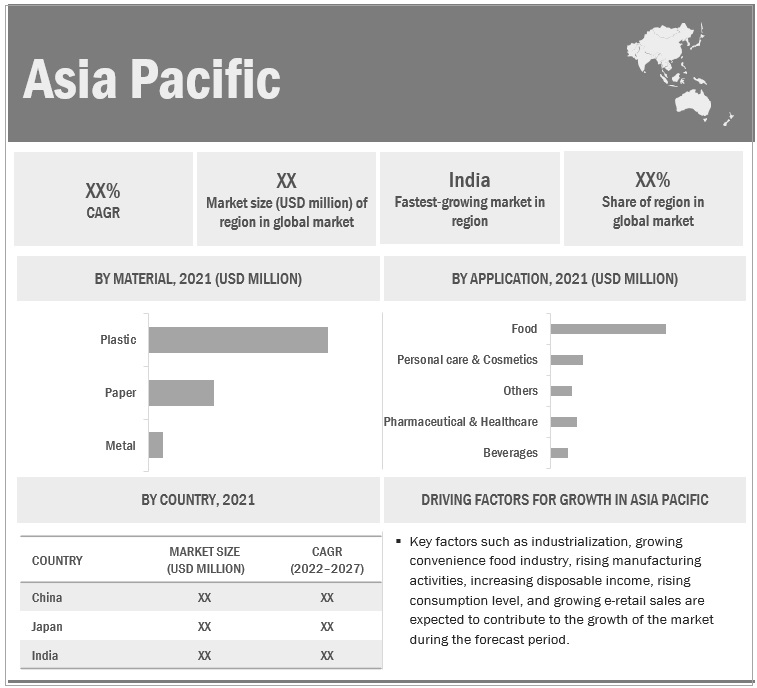

Asia Pacific is projected to account for the highest CAGR in the flexible packaging market during the forecast period

Asia Pacific region witnessed the fastest-growing flexible packaging market. The various countries which are covered in this region are India, China, Japan, Australia, South Korea, and the Rest of Asia Pacific. Countries such as India, China, and Japan are expected to post high growth in the flexible packaging market due to growing developmental activities and rapid economic expansion. Additionally, the increasing population in these countries presents a huge customer base for FMCG products and food & beverages, which, in turn, is expected to lead to the growth of the flexible packaging market.

By Material Type, the Paper segment accounted for the highest growth during the forecast period

The shift toward flexible packaging options made of paper is one of the major trends that is anticipated to have an impact on the flexible packaging business in the future. This is consistent with the rising popularity of environmentally friendly and sustainable packaging solutions. Paper-based packaging is more practical because it is both recyclable and biodegradable in nature. Hence, due to these properties, paper-made packaging products will have a great demand in the future as many manufacturers move towards sustainable packaging options.

By Printing Technology, the Flexography segment accounted for the second-highest CAGR during the forecast period

Brands that promote goods as diverse as food, wine, motor oil, and grass seed prefer flexographic printing over other printing techniques. Flexo now provides advantages that are highly appealing to both product marketing and purchasing management thanks to newfound capacities to produce top-quality images and graphics, deliver high consistency and repeatability from job to job, and enable quick, economical changeovers that support small-quantity runs. As some market segments grow and make use of flexographic printing's benefits, its popularity is anticipated to soar rapidly.

Flexible Packaging Market Players

Flexible packaging companies comprises major manufacturers such as Huhtamaki Oyj (Finland), Berry Global Group Inc. (US), Amcor Limited. (Australia), Mondi Group.(UK), and Sonoco Products Company (US) were the leading players in the flexible packaging market. Expansions, acquisitions, joint ventures, and new product developments are some of the major strategies adopted by these key players to enhance their positions in the flexible packaging market.

Please visit 360Quadrants to see the vendor listing of Top 21 Flexible Packaging Companies, Worldwide 2023

Flexible Packaging Market Report Scope

|

Report Metrics |

Details |

| Market Size Value in 2022 | USD 248.9 billion |

| Revenue Forecast in 2027 | USD 315.5 billion |

| CAGR | 4.8% |

| Years Considered | 2020-2027 |

| Base year | 2021 |

| Forecast period | 2022-2027 |

| Unit considered | Value (USD Billion), and Volume (Kilo Ton) |

| Segments | Packaging Type, Material, Printing Technology, End Use Industry, and Region |

| Regions | North America, Europe, South America, APAC, Middle East, and Africa. |

| Companies | The major players are Huhtamaki Oyj (Finland), Berry Global Group Inc. (US), Amcor Limited. (Australia), Mondi Group.(UK), Sonoco Products Company (US), Westrock Company (US), Constantia Flexibles (Austria), Sealed Air Corporation (US), Transcontinental Inc (Canada), DS Smith (UK), and others are covered in the flexible packaging market. |

This research report categorizes the global flexible packaging market on the basis of Type, Application, and Region.

Flexible Packaging Market by Packaging Type

- Pouches

- Rollstock

- Bags

- Films & Wraps

- Others

Flexible Packaging Market by Material

- Plastic

- Paper

- Metal

Flexible Packaging Market by Printing Technology

- Rotogravure

- Flexography

- Digital Printing

- Others

Flexible Packaging Market by End Use Industry

- Food

- Beverages

- Pharmaceutical & Healthcare

- Personal Care & Cosmetics

- Others

Flexible Packaging Market by Region

- North America

- Europe

- Asia Pacific (APAC)

- South America

- Middle East

- Africa

Recent Developments

- In October 2022, For the relaunch of its premium Appetitt brand, Mondi Group worked with renowned Norwegian pet food company Felleskjøpet to transition to recyclable high-barrier packaging.

- In September 2022, Huhtamaki Oyj invested in the sustainable packaging fund run by Emerald Technology Ventures AG, which focuses on cutting-edge sustainable packaging technologies.

- In September 2022, Sonoco Products Company has acquired. S.P. Holding, Skjern A/S, a leading producer of high-grade paperboard from 100% recycled paper for rigid paper containers, tubes and cores, and other applications.

- In September 2022, New research and development (R&D) facility is being built at Mondi Steinfeld in Germany with an estimated €5 million investment by Mondi Group.

- In September 2022, Berry Global Group Inc. has announced a collaboration with Mars Inc., to launch its popular pantry-sized treats in polyethylene terephthalate (PET) jars that have been optimized by including 15% recycled plastic content, i.e., post-consumer resin (PCR).

- In August 2022, Amcor Limited acquired DG Pack, which is currently known as Amcor Flexibles CZ • Prostejov, a world-class flexible packaging plant.

- In August 2022, Amcor Limited opened an innovation center in China.

- In May 2022, Amcor Limited expanded its product portfolio by adding High Shield laminates to the pharmaceutical packaging portfolio.

- In May 2022, Berry Global Group Inc. has launched a refuse sack business in the name of Ruffies in the United Kingdom (UK).

- In January 2022, Huhtamaki Oyj acquired full ownership of its Polish joint venture firm, Huhtamaki Smith Anderson sp. z o.o, from Smith Anderson Group Ltd.

Frequently Asked Questions (FAQ):

What are the major drivers driving the growth of the Flexible Packaging Market?

The major drivers influencing the growth of the Flexible Packaging market are increasing demand for food products in the food industry, beverages, Pharmaceutical and Healthcare, Personal care, and cosmetics.

What are the major challenges in the Flexible Packaging Market?

The major challenge in the Flexible Packaging market is the rapid change in the technology for producing flexible packaging products.

What are the restraining factors in the Flexible Packaging Market?

The major restraining factor faced by the flexible packaging market is the high cost of raw materials which are used to make a wide variety of flexible packaging products and the non-availability of good recycling infrastructure.

What is the key opportunity in the Flexible Packaging Market?

The growing demand for sustainable packaging has a new opportunity for the Flexible Packaging market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

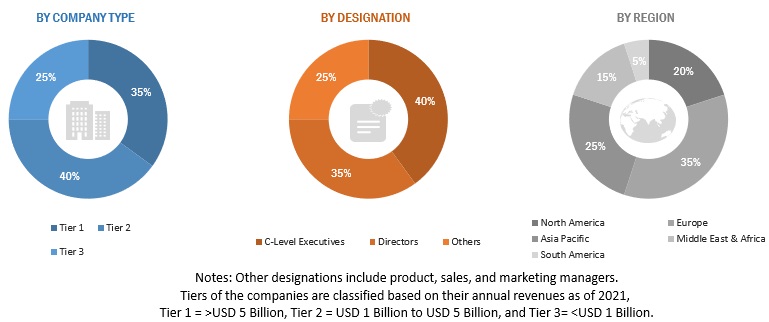

This research involved the use of extensive secondary sources and databases, such as Factiva and Bloomberg, to identify and collect information useful for a technical and market-oriented study of the flexible packing market. Primary sources included industry experts from related industries and preferred suppliers, manufacturers, distributors, technologists, standards & certification organizations, and organizations related to all segments of the value chain of this industry. In-depth interviews have been conducted with various primary respondents, such as key industry participants, subject matter experts (SMEs), executives of key companies, and industry consultants, to obtain and verify critical qualitative and quantitative information as well as to assess growth prospects.

Flexible Packaging Market Secondary Research

In the secondary research process, various sources such as annual reports, press releases, and investor presentations of companies, white papers, and publications from recognized websites and databases have been referred to for identifying and collecting information. Secondary research has been used to obtain key information about the industry's supply chain, the total pool of key players, market classification and segmentation according to the industry trends to the bottom-most level, regional markets, and key developments from both market-and technology-oriented perspectives.

Flexible Packaging Market Primary Research

The flexible packaging market comprises several stakeholders in the supply chain, which include suppliers, processors, and end-product manufacturers. Various primary sources from the supply and demand sides of the markets have been interviewed to obtain qualitative and quantitative information. The primary participants from the demand side include key opinion leaders, executives, vice presidents, and CEOs of companies in the flexible packaging market. Primary sources from the supply side include associations and institutions involved in the flexible packaging industry, key opinion leaders, and processing players.Following is the breakdown of primary respondents

To know about the assumptions considered for the study, download the pdf brochure

Flexible Packaging Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the global flexible packaging market. The research methodology used to estimate the market size includes the following:

- The key players in the industry were identified through extensive secondary research.

- The supply chain of the industry and market size, in terms of value, were determined through primary and secondary research.

- All percentage share split, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of key industry players, along with extensive interviews with key officials, such as directors and marketing executives.

Market Size Estimation: Bottom-Up Approach and Top-Down Approach

Flexible Packaging Market Data Triangulation

After arriving at the total market size from the estimation process explained above, the overall market was split into several segments and subsegments. To complete the overall market size estimation process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures have been employed, wherever applicable. The data have been triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market size has been validated by using both the top-down and bottom-up approaches.

Flexible Packaging Market Report Objectives

- To define, describe, and forecast the global flexible packaging market in terms of value

- To provide insights regarding the significant factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To analyze and forecast the market based on type, region, and end-use application.

- To forecast the market size, in terms of value, with respect to six main regions: North America, Europe, South America, APAC, Middle East, and Africa.

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape

- To strategically profile key players in the market

- To analyze competitive developments in the market, such as new product launches, capacity expansions, and mergers & acquisitions

- To strategically profile the leading players and comprehensively analyze their key developments in the market

The market has been further analyzed for the key countries in each of these regions.

Flexible Packaging Market Report Available Customizations

Along with the given market data, MarketsandMarkets offers customizations as per the specific needs of the companies. The following customization options are available for the report:

Product Analysis:

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Flexible Packaging Market Regional Analysis

- Further breakdown of the Rest of the APAC Flexible Packaging market

- Further breakdown of the Rest of Europe's Flexible Packaging market

Flexible Packaging Market Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Flexible Packaging Market