Battery Separators Market by Battery Type (Lead Acid and Li-ion), Material (Polyethylene and Polypropylene), Technology (Dry and Wet), End-Use (Automotive, Consumer Electronics, Industrial), and Region - Global Forecast to 2028

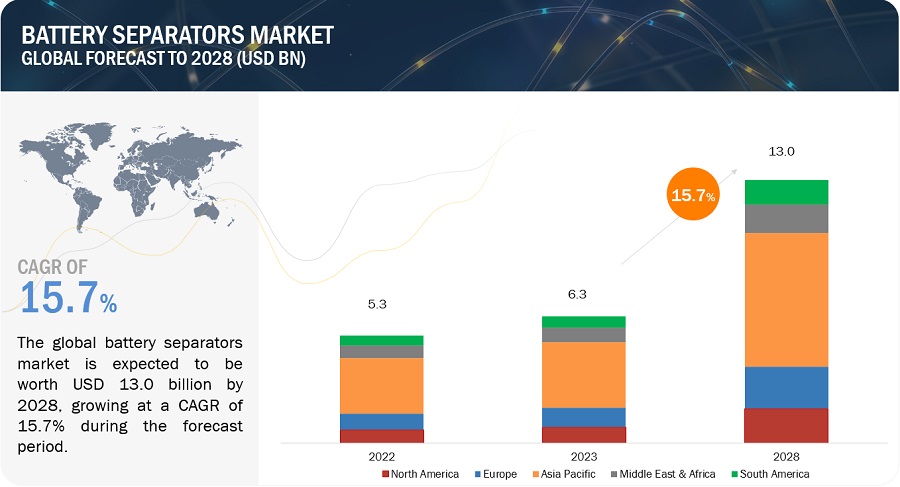

The global battery separators market is projected to grow from USD 6.3 billion in 2023 to USD 13.0 billion by 2028, at a CAGR of 15.7% during the forecast period. Industrial, automotive, and consumer electronics sectors are driving the growth in battery separators market. In industrial applications, they ensure reliable energy storage for uninterrupted operations and facilitate the integration of renewable energy sources. The automotive sector benefits from high-performance separators in electric and hybrid vehicles, enhancing battery efficiency and safety. In consumer electronics, battery separators enable the development of compact, powerful devices, supporting the rise of smartphones, tablets, and wearable technology.

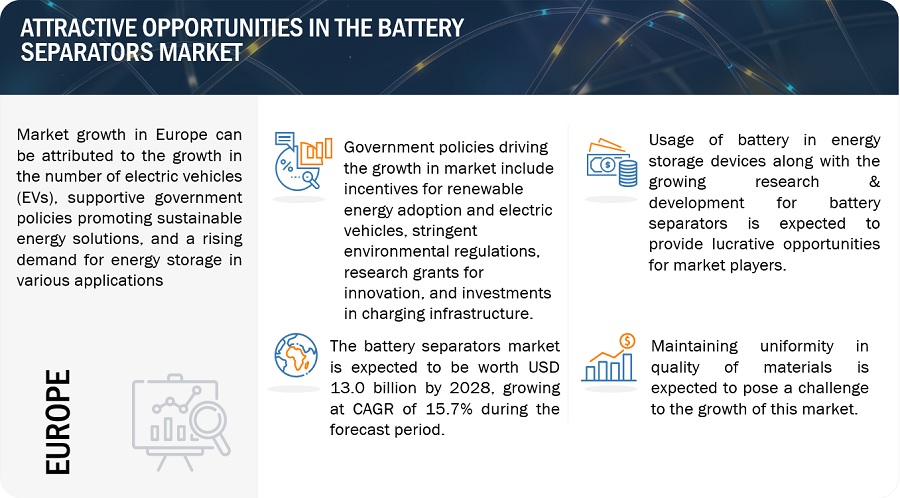

Attractive Opportunities in the Battery Separators Market

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics:

Driver: Increasing adoption of lithium-ion batteries in the renewable sector

Deep-cycle lithium-ion and lead-acid batteries emerge as crucial storage options for renewable energy. Despite the fact that lithium batteries are moderately new to this area, they are tending to a portion of the restrictions related with lead-acid other options. Moreover, lithium batteries are replacing lead-acid batteries in different applications, including private, business, and sporting vehicle use. As additional enterprises perceive the advantages of changing to sustainable power, there is an high focus on creating further developed batteries. The developing electric vehicle market, with its emphasis on more secure, lighter, and more productive batteries, is one of the huge driver for battery separators market. Also, the flood in sustainable power, driven by progressions in lithium batteries, grows opportunities for energy capacity, helping both the climate and the economy and one more key driver for the battery separators market is the developing interest for energy capacity arrangements in the telecom area. As worldwide network increments and the dependence on cell phones strengthens, there's an elevated requirement for solid and enduring batteries in telecom foundation. The battery separators market is likely to be significantly influenced by the growing preference for lithium-ion batteries in the mentioned earlier and other industries.

Restraints: Proper storage and transportation of batteries

Dealing with batteries of all types involves inherent risks. Without appropriate safeguards, batteries can present dangers to local people, whether they are being used, charging, or just put away. The potential issues incorporate overheating, consuming, or exploding battery chargers which prompts electrical shock and burns. These battery-related dangers can bring about accidents, deaths, and property loss. For example, misusing of lithium-ion batteries leads to numerous work-related injuries. Beyond lithium-ion batteries, even commonly used lead-acid batteries and standard 9-volt dry cell batteries from supermarkets can pose serious risks to those nearby. Hence, the absence of appropriate storage and transportation of batteries is driving legislatures to make a severe move against producers of these batteries, which will hamper the development of the battery separators market.

Opportunity: Battery usage in energy storage devices

A rapidly extending innovation in the sustainable energy area is battery energy capacity frameworks, perceived as effective means to reduce dependence on fossil fuels and address power fluctuation. Lithium-ion batteries are one of the significant battery types used in energy storage devices. Furthermore, lead-acid batteries are a great decision for a battery energy storage since they are a more reasonable battery choice and are recyclable. They are additionally more secure than a few different chemistries because their active components are not flammable. These batteries are intended for widespread performance with high power yield in different applications, for example, data center and others. As data centers use lead-acid batteries, their demand is expected to increase, and this further gives an opportunity to the development of the battery separators market.

Challenge: Lack of government support and infrastructure in emerging economies

The adoption of sustainable energy sources, various countries' governments are prioritizing the provision of subsidies and incentives to support the manufacturing of lithium-ion batteries. In certain nations, governments offer exemptions and incentives to encourage the development of grid-connected power storage facilities and the adoption of electric vehicles. To adopt the electric vehicles, a few countries have executed strategies including exclusions from or refunds on road tolls. However, supportive capital markets, battery research promotion, early-stage product facilitation, and scaling up electric vehicle manufacturing are all necessary for emerging markets. To meet current and future energy capacity requirements, India's thriving lead-acid battery manufacturing sector needs to be expanded. Support for Research and development is expected to reduce initial investment costs, and involve small and medium-sized enterprises (SMEs) in the production of industrial units for the ecosystem that manufactures rechargeable battery cells. Therefore, the absence of government support and infrastructure in developing economies is anticipated to pose a challenge to the expansion of the battery separators market.

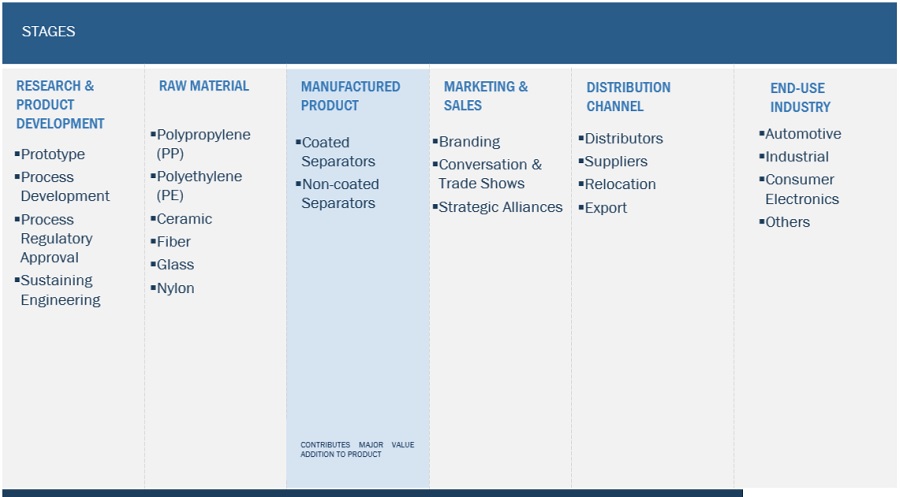

Battery Separators Market: Ecosystem

Prominent companies in this market include well-established, and financially stable manufacturers of battery separators market. These companies have been operating in the market for several years and possess a diversified product portfolio and strong global sales and marketing networks. Prominent companies in this market include Asahi Kasei Corporation (Japan), ENTEK (US), Shanghai Energy New Materials Technology Co., Ltd. (China), SK ie technology (South Korea), Toray Industries, Inc. (Japan), and UBE Corporation (Japan).

"Polypropylene segment, by material, is estimated to account for the highest CAGR during the forecast period."

Polypropylene (PP) is one of the most adaptable polymers accessible and can be utilized as fiber and plastic in various industries, including automotive and medical devices. Specifically, polypropylene separators find widespread use in the batteries of electric vehicles (EVs) to enhance battery performance and safety. These separators are designed to withstand high temperatures and provide excellent chemical stability, making them ideal for use in lithium-ion batteries. As the demand for electric vehicles continues to grow, the use of polypropylene in battery separators is expected to increase, contributing to the development of advanced and reliable energy storage systems. The interest for polypropylene is expected to rise further because of expanding needs in auto parts, design attire, medical services gadgets, and different areas.

"Others segment, by battery type, is estimated to account for the highest CAGR during the forecast period."

The battery industry is growing rapidly, and the demand for cost-effective and high-quality battery materials is increasing. Different types of batteries, such as nickel-metal hydride, nickel cadmium, and antacid frameworks. Basic batteries are utilized in an extensive variety of family things, like compact Disc players, controllers, lights, computerized cameras, and others. The battery separator market is driven by the overall growth in the battery industry and the rising demand for energy storage solutions, particularly in consumer electronics and household appliances. The general development in the battery business, combined with a rising interest for cost effective and great battery materials, fills in as the essential driver powering the interest for battery separators market.

"Automotive segment, by end-use, is estimated to account for the highest CAGR during the forecast period."

The demand for battery-driven vehicles, such as hybrid electric vehicles and plug-in hybrid electric vehicles, is primarily driven by the automotive end-use sector. Automotive is the largest end-use sector for battery separators market. Additionally, there are various advancements in automotive lead-acid batteries to meet the growing electrical demands of modern vehicles and the rising demand for efficiency. Moreover, continuous advancements in automotive lead-acid batteries are directed towards fulfilling the increasing electrical needs of modern vehicles and improving efficiency. These headways add to the expanded use of batteries in the auto area. Thus, the rising interest for batteries inside the automotive sector. As a result, the increasing demand for batteries in the automotive industry is anticipated to simultaneously boost the market demand for battery separators.

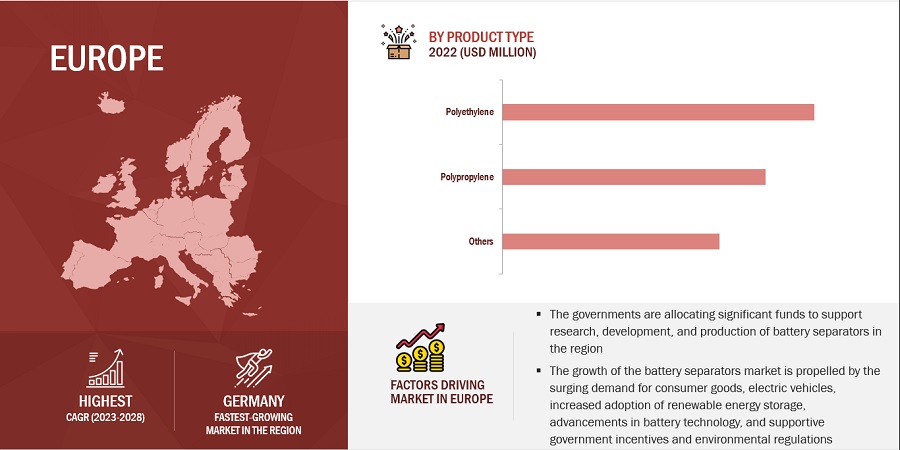

"Europe region is estimated to account for the highest CAGR during the forecast period."

The demand for batteries in Europe is significant, driven by their essential applications as sustainable, clean, and compact sources of power in consumer electronics and automotive. In, the automotive industry, there is a growing emphasis on electric vehicles, and the adoption of batteries for sustainable and efficient power solutions is on the rise and the consumer electronics market in Europe is witnessing notable growth, especially in the segment of wearable devices. The combined demand from both the automotive and consumer electronics sectors, along with the battery manufacturers, positions Europe as a region experience the highest CAGR in the battery separators market during the forecast period.

To know about the assumptions considered for the study, download the pdf brochure

Source: Secondary Research, Expert Interviews, and MarketsandMarkets Analysis

Key Market Players

Major companies in the battery separators market include Asahi Kasei Corporation (Japan), ENTEK (US), Shanghai Energy New Materials Technology Co., Ltd. (China), SK ie technology (South Korea), Toray Industries, Inc. (Japan), and UBE Corporation (Japan) among others. A total of 26 major players have been covered. These players have adopted product launches, agreements, joint ventures, investments, acquisitions, mergers, and expansions as the major strategies to consolidate their position in the market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market Size Available for Years |

2018–2028 |

|

Base Year Considered |

2022 |

|

Forecast Period |

2023–2028 |

|

Forecast Units |

Value (USD Billion) and Volume (Million Square Meters) |

|

Segments Covered |

Type, Material, Thickness, Technology, Battery Type, End-use, and Region |

|

Geographies Covered |

Asia Pacific, Europe, North America, the Middle East & Africa, and South America |

|

Companies Covered |

The major market players include Asahi Kasei Corporation (Japan), Shanghai Energy New Materials Technology Co., Ltd. (China), SK ie technology (South Korea), Toray Industries, Inc. (Japan), Ahlstrom (Finland), Sinoma Science & Technology Co., Ltd. (China), Bernard Dumas (France), Cangzhou Mingzhu Plastic Co., Ltd. (China), Delfortgroup AG (Asutria), Eaton (Europe), ENTEK (US), Freudenberg (Germany), Hebei Gellec New Energy Science & Technology Co., Ltd. (China), Mitsubishi Paper Mills Limited (Japan), Hollingsworth & Vose (US), Nanografi Nano Technology (Turkey), Solvay (Belgium), Sumitomo Chemical Co., Ltd. (Japan), Teijin Limited (Japan), UBE Corporation (Japan), W-Scope Corporation (Japan), and others. |

This research report categorizes the battery separators market based on Type, Material, Thickness, Technology, Battery Type, End-use, and Region.

Based on Type, the battery separators market has been segmented as follows:

- Coated Separators

- Non-coated Separators

Based on Material, the battery separators market has been segmented as follows:

- Polypropylene

- Polyethylene

- Others

Based on Thickness, the battery separators market has been segmented as follows:

- 5µM–10µm

- 10µM–20µM

Based on Technology, the battery separators market has been segmented as follows:

- Dry Battery Separator

- Wet Battery Separator

Based on Battery Type, the battery separators market has been segmented as follows:

- Lithium-ion (Li-ion)

- Lead-acid

- Others

Based on End-use, the battery separators market has been segmented as follows:

- Automotive

- Consumer Electronics

- Industrial

- Others

Based on region, the battery separators market has been segmented as follows:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In October 2023, Asahi Kasei is set to expand its coating capacity for lithium-ion battery (LIB) separators, with the aim of meeting the increasing demand for electric vehicles, particularly in North America. The expansion will raise the company's coating capacity to approximately 1.2 billion m2/year, enabling the supply of coated separators for batteries equivalent to 1.7 million electric vehicles. This investment is part of Asahi Kasei's strategy to strengthen its LIB separator supply infrastructure for automotive applications and to support the significant growth in electric vehicle production, especially in North America. The expansion will involve the installation of new coating lines at existing Asahi Kasei facilities in the US, Japan, and South Korea, with the start-up scheduled in succession from the first half of fiscal year 2026.

- In December 2023, Solvay has finalized an agreement with the U.S. Department of Energy grant to build a facility in Augusta, GA, to manufacture battery-grade PVDF, which is used as a lithium-ion binder and separator coating in electric vehicle batteries. The facility, expected to be operational in 2026. This agreement will significantly strengthen Solvay's position in the battery separator market.

- In January 2022, ENTEK acquired AEF, a leading provider of material handling systems. Building both extrusion and material handling equipment, ENTEK expanded its manufacturing capabilities in its recently completed facility in Henderson, NV, offering the required space and resources to support the expansion of the merged businesses.

Frequently Asked Questions (FAQ):

What is the key driver for the battery separators market?

Growing adoption of EVs and plug-in vehicles as a driving force for the battery separators market

Which region is expected to register the highest CAGR in the battery separators market during the forecast period?

The battery separators market in Europe is estimated to register the highest CAGR during the forecast period.

What is the major end-use of battery separators?

The automotive segment is the major end-use of battery separator. Due to the surging demand for electric vehicles and the continuous advancements in automotive battery technologies, necessitating high-performance separators for enhanced safety and efficiency in the rapidly growing electric mobility sector.

Who are the major players of the battery separators market?

The key players operating in the market include Asahi Kasei Corporation (Japan), ENTEK (US), Shanghai Energy New Materials Technology Co., Ltd. (China), SK ie technology (South Korea), Toray Industries, Inc. (Japan), and UBE Corporation (Japan).

What is the total CAGR expected to record for the battery separators market during 2023-2028?

The market is expected to record a CAGR of 15.7 % from 2023-2028. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

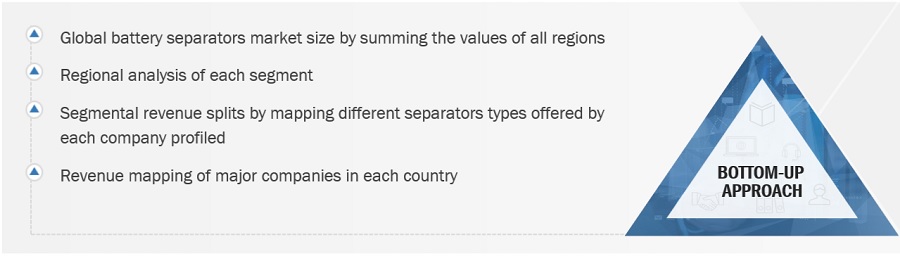

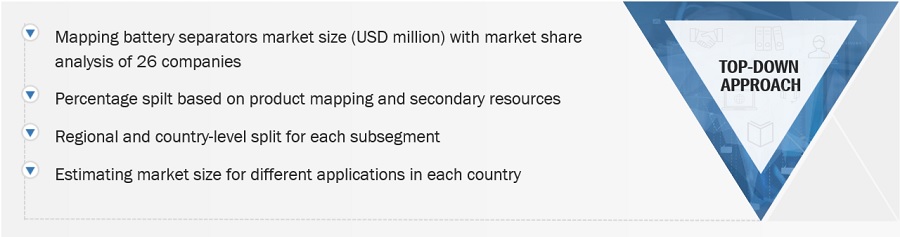

The study involved four major activities in estimating the current size of the battery separators market. Exhaustive secondary research was done to collect information on the market, peer markets, and parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the battery separators value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources for this research study include annual reports, press releases, and investor presentations of companies; white papers; certified publications; and articles by recognized authors; gold- and silver-standard websites; battery separators manufacturing companies, regulatory bodies, trade directories, and databases. The secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and regional markets. It has also been used to obtain information about key developments from a market-oriented perspective.

Primary Research

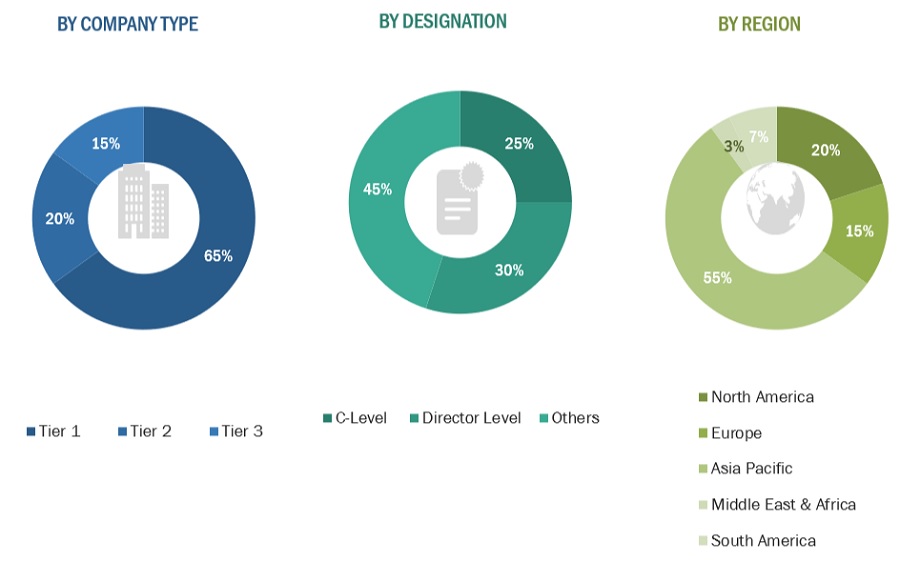

The battery separators market comprises several stakeholders, such as such as raw material suppliers, technology support providers, battery separators manufacturers, and regulatory organizations in the supply chain. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Primary sources from the supply side included industry experts such as Chief Executive Officers (CEOs), vice presidents, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the battery separators market . Primary sources from the demand side included directors, marketing heads, and purchase managers from various sourcing industries. Following is the breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches have been used to estimate and validate the total size of the battery separators market. These approaches have also been used extensively to estimate the size of various dependent subsegments of the market. The research methodology used to estimate the market size included the following:

The following segments provide details about the overall market size estimation process employed in this study

- The key players in the market were identified through secondary research.

- The market shares in the respective regions were identified through primary and secondary research.

- The value chain and market size of the battery separators market, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of annual and financial reports of the top market players and interviews with industry experts, such as CEOs, VPs, directors, sales managers, and marketing executives, for key insights, both quantitative and qualitative.

Global Battery separators market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Battery separators market Size: Top-Down Approach

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the oil & gas sector.

Market Definition

According to Hollingsworth & Vose, a battery separator is a polymeric membrane placed between the positively charged anode and the negatively charged cathode. The separators act as isolators. Ions can freely go across separators, but these are not electrically conductive. The main purpose of battery separators is to isolate the negative and positive electrodes. They must obstruct any processes which negatively affect the electrochemical energy efficiency of a battery. This helps in avoiding electrical short circuits while permitting rapid transportation of ionic charge carriers to complete the circuit during the transit of current in an electrochemical cell.

Key Stakeholders

- Raw material manufacturers

- Technology support providers

- Manufacturers of battery separators

- Traders, distributors, and suppliers

- Regulatory Bodies and Government Agencies

- Research & Development (R&D) Institutions

- End-use Industries

- Consulting Firms, Trade Associations, and Industry Bodies

- Investment Banks and Private Equity Firms

Report Objectives

- To analyze and forecast the market size of battery separators market in terms of value

- To provide detailed information regarding the major factors (drivers, restraints, challenges, and opportunities) influencing the regional market

- To analyze and forecast the global battery separators market on the basis of battery type, thickness, type, technology, material, end-use, and region

- To analyze the opportunities in the market for stakeholders and provide details of a competitive landscape for market leaders

- To forecast the size of various market segments based on four major regions: North America, Europe, Asia Pacific, South America, and the Middle East & Africa, along with their respective key countries

- To track and analyze the competitive developments, such as acquisitions, partnerships, collaborations, agreements and expansions in the market

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the client-specific needs.

The following customization options are available for the report:

- Additional country-level analysis of the battery separators market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Battery Separators Market