Coated Fiber Market by Material (Aluminum, Copper, Nickel, and Others), Coating Method (Freezing Method, Electroplating, Electroless Plating, and Others), End-Use Industry (Oil & Gas, Defense & Aerospace, Medical, Telecommunication & Data Centers, Research & Development, and Others), and Region (Asia Pacific, North America, Europe, Middle East & Africa and Latin America) - Global Forecast to 2027

The coated fiber market is projected to reach USD 11.7 billion by 2027, at a CAGR of 4.5% from USD 9.4 billion in 2022. One of the major factors contributing to the growth of the coated fiber market is the growing consumption of coated fibers in oil & gas, defense and aerospace industries. Also, the rising demand for coated fibers for use in the production of semiconductors, photovoltaic cells and other electronic assemblies is driving the market.

Attractive Opportunities in the Coated Fiber Market

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Driver: Increased demand from harsh environment-related applications

Harsh environment applications require the use of optical fiber specially coated with metal. For example, the oil & gas industry uses downhole optical fiber in wells where temperatures can reach over 300°C. Against such high temperatures, polymer-coated fibers do not keep their original mechanical properties. Therefore, coated fiber is used for high-temperature environments instead of polymer-coated fibers. Moreover, there are various applications where optical fiber may get exposed to ionizing radiation, such as nuclear storage facilities and nuclear power plants. Such applications require optical fiber that has been explicitly designed to be minimally impacted by ionizing radiation. Metal-coated fibers are sustainable in harsh environments. Hence, the growing demand from harsh environment-related applications is driving the coated fibers market size growth.

Restraints: Volatility in raw material prices

The coated fiber manufacturing process includes various raw materials, such as oxides (aluminum, zirconium, titanium, and selenium), fluorides (strontium, calcium, and magnesium), and metals (copper, gold, and silver). The raw material market for coated fibers is highly volatile, with a major impact on the price fluctuations of the metals and oxides, such as TiO2, indium, gold, copper, and silver. The availability and prices of raw materials, especially metals and oxides, fluctuate, and the rise in their prices can adversely affect the manufacturing cost.

Opportunities: Increasing adoption of advanced automotive electronics

The demand for automotive electronics in the transportation end-use industry is increasing due to the rising income levels worldwide, increasing need for a safe and convenient drive, emergence of intelligent transport systems, and growing need to minimize environmental pollution. Optical coatings form an essential part of advanced automotive electronics systems and devices. The emergence of advanced driver assistance, along with the communication technology and entertainment system features, is also creating an opportunity for the optical coatings market which is in turn leading to the growth of the coated fiber market.

Challenges: Maintaining the environmental durability of coated fibers

Environmental durability of the coating is defined and tested normally according to American military specifications and sometimes according to civilian standards [International Organization of Standardization (ISO) and American National Standards Institute (ANSI)]. These specifications or standards contain requirements and test conditions for the environmental durability of optical coatings. This factor poses a challenge to the manufacturers of optical coatings to adhere to environmental durability standards.

“Oil & Gas was the largest end use industry for coated fiber market in 2021, in terms of value”

Its resistance to high temperatures for a longer period of time, makes it suitable for oil & gas industry where fibers are exposed to tremendously high levels of temperature. Because of their electrical conductivity and EMI shielding qualities, copper and nickel-coated carbon fiber mats and veils have become more common. Additionally, the deployment of endoscopes, robotic surgeries, vascular procedures and detection, precision biopsies, and biosensing activities all make use of metal-coated fibers.

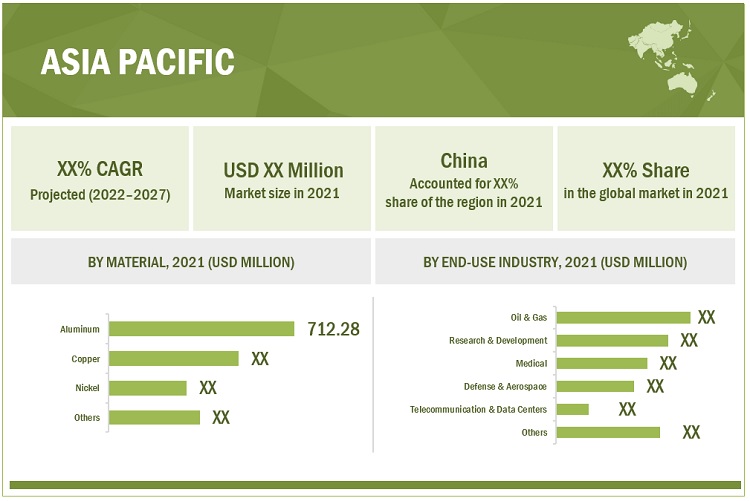

“Asia Pacific was the largest market for coated fiber in 2021, in terms of value.”

The expansion of the coated fiber market in Asia Pacific has been greatly aided by the existence of numerous producers. The market for coated fiber in Asia Pacific is expanding because of the region's increased emphasis on R&D activities and the use of innovative composites for tough environments. In order to increase operational effectiveness in this region, major industry participants in the global coated fiber market are setting up production facilities in developing nations like China and India. They are also extending their current production capacity.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The key players in this market are Dupont (US), Art Photonics GmbH (Germany), IVG Fiber Ltd. (US), Technical Fiber Products Limited (UK), Fiber guide Industries Ltd. (US), Conductive Composites (US), PPG Industries (US), Nippon Sheet Glass Co., Ltd. (Japan), ZEISS International (Germany) and Newport Corporation (US). Continuous developments in the market—including new product launches, mergers & acquisitions, agreements, and expansions—are expected to help the market grow. Leading manufacturers of coated fiber market have opted for new product launches to sustain their market position.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Years considered for the study |

2018-2027 |

|

Base Year |

2021 |

|

Forecast period |

2022–2027 |

|

Units considered |

Volume (Kilotons); Value (USD Billion) |

|

Segments |

Material, Coating Method, End-Use Industry and Region |

|

Regions |

Asia Pacific, North America, Europe, Middle East & Africa, and Latin America |

|

Companies |

The key players in this market are Dupont (US), Art Photonics GmbH, IVG Fiber Ltd., Technical Fiber Products Limited, Fiber guide Industries Ltd., Conductive Composites, PPG Industries (US), Nippon Sheet Glass Co., Ltd. (Japan), ZEISS International (Germany), Newport Corporation (US) |

This report categorizes the global coated fiber market based on material, coating method, end-use industry, and region.

On the basis of material, the coated fiber market has been segmented as follows:

- Aluminum

- Copper

- Nickel

- Others

On the basis of coating method, the coated fiber market has been segmented as follows:

- Freezing Method

- Electroplating

- Electroless Plating

- Others

On the basis of end use industry, the coated fiber market has been segmented as follows:

- Oil & Gas

- Defense & Aerospace

- Medical

- Telecommunication & Data Centers

- Research & Development

- Others

On the basis of region, the coated fiber market has been segmented as follows:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- Latin America

Frequently Asked Questions (FAQ):

What is the expected growth rate of coated fiber market?

The forecast period for coated fiber market in this study is 2022-2027. The coated fiber market is projected to grow at CAGR of 4.5%, in terms of value, during the forecast period.

Who are the major key players in coated fiber market?

Dupont (US), Art Photonics GmbH (Germany), IVG Fiber Ltd. (US), Technical Fiber Products Limited (UK), PPG Industries (US), Nippon Sheet Glass Co., Ltd. (Japan) are the major players in the coated fiber market.

Which is the largest region in the coated fiber market?

Asia Pacific is the largest region in the coated fiber market. The increasing demand from industries like oil & gas, defense & aerospace has been driving the market’s growth. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Content

1 Introduction

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered in the Report

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology

2.1 Market Share Estimation

2.1.1 Secondary Data

2.1.1.1 Key Data from Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data from Primary Sources

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions

3 Executive Summary

4 Premium Insights

4.1 Significant Opportunities in Market, 2022–2027

4.2 Coated Fiber Market, By Material

4.3 Coated Fiber, By Coating Method

4.4 Coated Fiber, End-Use Industry

4.3 Coated Fiber, By Region

5 Market Overview

5.1 Introduction

5.2 Market Dynamics

5.3.1 Drivers

5.3.2 Restraints

5.3.3 Opportunities

5.4.4 Challenges

5.3 Porter's Five Forces Analysis

5.4.1 Bargaining Power of Suppliers

5.4.2 Bargaining Power of Buyers

5.4.3 Threat of New Entrants

5.4.4 Threat of Substitutes

5.4.5 Degree of Competition

5.4 Supply Chain Analysis

5.5 Ecosystem: Coated Fiber Market

5.6 Value Chain Analysis

5.7 Technology Analysis

5.8 Pricing Analysis

5.9 Trends and Disruptions Impacting Customers

6 Coated Fiber Market, By Material

6.1 Aluminum

6.2 Copper

6.3 Nickel

6.4 Others

7 Coated Fiber, By Coating Method

7.1 Freezing Method

7.2 Electroplating

7.3 Electroless Plating

7.4 Others

8 Coated Fiber, By End-Use Industry

8.1 Oil & Gas

8.2 Defense & Aerospace

8.3 Medical

8.4 Telecommunication & Data Centers

8.5 Research & Development

8.6 Others

9 Coated Fiber, By Region

9.1 Introduction

9.2 North America

9.2.1 Coated Fiber Market Size in North America, By Material

9.2.2 Coated Fiber Market Size in North America, By Coating Method

9.2.3 Coated Fiber Market Size in North America, By End-Use Industry

9.2.4 Coated Fiber Market Size in North America, By Country

9.2.4.1 Canada

9.2.4.1.1 Coated Fiber Market Size in Canada, By End-Use Industry

9.2.4.2 US

9.2.4.2.1 Coated Fiber Market Size in US, By End-Use Industry

9.3 Europe

9.3.1 Coated Fiber Market Size in Europe, By Material

9.3.2 Coated Fiber Market Size in Europe, By Coating Method

9.3.3 Coated Fiber Market Size in Europe, By End-Use Industry

9.3.4 Coated Fiber Market Size in Europe, By Country

9.3.4.1 Germany

9.3.4.1.1 Coated Fiber Market Size in Germany, By End-Use Industry

9.3.4.2 France

9.3.4.2.1 Coated Fiber Market Size in France, By End-Use Industry

9.3.4.3 UK

9.3.4.3.1 Coated Fiber Market Size in UK, By End-Use Industry

9.3.4.4 Italy

9.3.4.4.1 Coated Fiber Market Size in Italy, By End-Use Industry

9.3.4.5 Rest of Europe

9.3.4.5.1 Coated Fiber Market Size in Rest of Europe, By End-Use Industry

9.4 Asia Pacific

9.4.1 Coated Fiber Market Size in Asia Pacific, By Material

9.4.2 Coated Fiber Market Size in Asia Pacific, By Coating Method

9.4.3 Coated Fiber Market Size in Asia Pacific, By End-Use Industry

9.4.4 Coated Fiber Market Size in Asia-Pacific, By Country

9.4.4.1 China

9.4.4.1.1 Coated Fiber Market Size in China, By End-Use Industry

9.4.4.2 Japan

9.4.4.2.1 Coated Fiber Market Size in Japan, By End-Use Industry

9.4.4.3 India

9.4.4.3.1 Coated Fiber Market Size in India, By End-Use Industry

9.4.4.4 South Korea

9.4.4.4.1 Coated Fiber Market Size in South Korea, By End-Use Industry

9.4.4.5 Rest of Asia Pacific

9.4.4.5.1 Coated Fiber Market Size in Rest of Asia Pacific, By End-Use Industry

9.5 Middle East & Africa

9.5.1 Coated Fiber Market Size in Middle East & Africa, By Material

9.5.2 Coated Fiber Market Size in Middle East & Africa, By Coating Method

9.5.3 Coated Fiber Market Size in Middle East & Africa, By End-Use Industry

9.5.4 Coated Fiber Market Size in Middle East & Africa, By Country

9.5.4.1 Saudi Arabia

9.5.4.1.1 Coated Fiber Market Size in Saudi Arabia, By End-Use Industry

9.5.4.2 South Africa

9.5.4.2.1 Coated Fiber Market Size in South Africa, By End-Use Industry

9.5.4.3 Rest of Middle East & Africa

9.5.4.3.1 Coated Fiber Market Size in Rest of Middle East & Africa, By End-Use Industry

9.6 Latin America

9.6.1 Coated Fiber Market Size in Latin America, By Material

9.6.2 Coated Fiber Market Size in Latin America, By Coating Method

9.6.3 Coated Fiber Market Size in Latin America, By End-Use Industry

9.6.4 Coated Fiber Market Size in Latin America, By Country

9.6.4.1 Mexico

9.6.4.1.1 Coated Fiber Market Size in Mexico, By End-Use Industry

9.6.4.2 Brazil

9.6.4.2.1 Coated Fiber Market Size in Brazil, By End-Use Industry

9.6.4.3 Rest of Latin America

9.6.4.3.1 Coated Fiber Market Size in Rest of Latin America, By End-Use Industry

10 Competitive Landscape

10.1 Introduction

10.2 Market Share Analysis

10.3 Market Ranking

10.4 Market Evaluation Framework

10.4.1 Product Launches and Developments

10.4.2 Expansions

10.4.3 Contracts and Agreements

10.4.4 Mergers & Acquisitions

10.5 Revenue Analysis of Top Market Players

10.6 Company Evaluation Matrix

10.6.1 Star

10.6.2 Emerging Leaders

11.6.3 Pervasive

11.6.4 Participants

11 Company Profiles

* (Business Overview, Products Mix, Recent Developments, SWOT Analysis, MnM view)

11.1 Dupont

11.2 Art Photonics GmbH

11.3 IVG Fiber Ltd.

11.4 Technical Fiber Products Limited

11.5 Fiber guide Industries Ltd.

11.6 Conductive Composites

11.7 PPG Industries

11.8 Nippon Sheet Glass Co., Ltd.

11.9 ZEISS International

11.10 Newport Corporation

*Details Might Not Be Captured in Case of Unlisted Companies.

Note: This is the tentative list, we will provide you the company profiles of major companies in this market.

12 Appendix

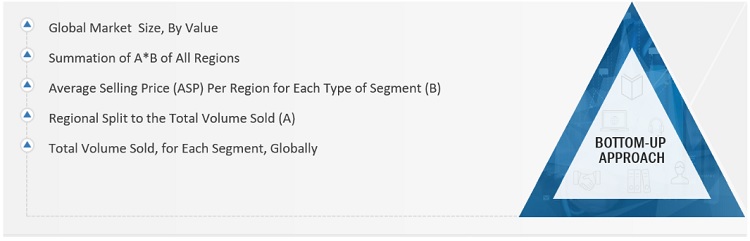

The study involved four major activities to estimate the size of coated fiber market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to identify and collect information for this study. These secondary sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, trade directories, articles from recognized authors, gold standard and silver standard websites, and databases.

Secondary research has been used to obtain key information about the value chain of the industry, monetary chain of the market, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The coated fiber market comprises several stakeholders in the value chain, which include raw material suppliers, manufacturers, distributors, and end users. Various primary sources from the supply and demand sides of the coated fiber market have been interviewed to obtain qualitative and quantitative information.

The primary interviewees from the demand side include key opinion leaders in end-use sectors. The primary sources from the supply side include manufacturers, associations, and institutions involved in the coated fiber industry.

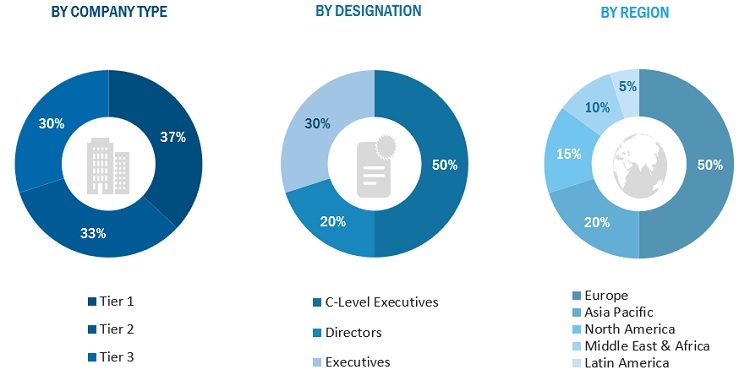

The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2021 available in the public domain, product portfolios, and geographical presence.

Other designations include consultants and sales, marketing, and procurement managers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches have been used to estimate and validate the size of the coated fiber market.

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of the key market players, along with extensive interviews for opinions with leaders such as directors and marketing executives.

Coated Fiber Market: Bottom-Up Approach 1

Source: MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the total market size from the estimation process explained above, the overall market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated by using both the top-down and bottom-up approaches and primary interviews. Hence, for every data segment, there have been three sources—top-down approach, bottom-up approach, and expert interviews. The data was assumed correct when the values arrived from the three sources matched.

Report Objectives

- To define, describe, and forecast the size of the coated fiber market, in terms of value and volume

- To provide detailed information regarding the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market

- To estimate and forecast the market size based on material, coating method, end-use industry, and region

- To forecast the size of the market with respect to major regions, namely, Europe, North America, Asia Pacific, and Middle East & Africa, and Latin America along with their key countries

- To strategically analyze micro markets with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of market leaders

- To track and analyze recent developments such as expansions, new product launches, partnerships & agreements, and acquisitions in the market

- To strategically profile key market players and comprehensively analyze their core competencies

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

- Regional Analysis

Further breakdown of a region with respect to a particular country or additional application

- Company Information

Detailed analysis and profiles of additional market players

Growth opportunities and latent adjacency in Coated Fiber Market