Benzoates Market by Type (Potassium Benzoate, Sodium Benzoate, Ammonium Benzoate), End-Use (Food & Beverage, Pharmaceutical, Personal Care), and Region (North America, Europe, Asia Pacific, Rest of the World) - Global Forecast to 2027

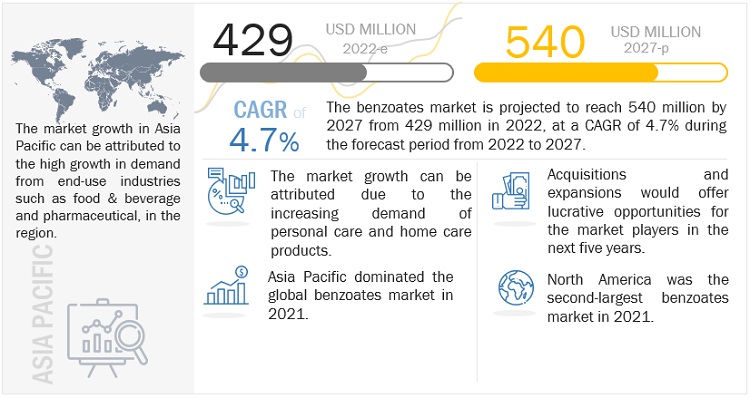

The benzoates market is projected to reach USD 540 million by 2027, at a CAGR of 4.7%. Factors such as the increasing demand for personal care and home care products are driving the benzoates market. Also, the demand of non-alcoholic, sugar-free products will fuel the benzoates market growth.

Global Benzoates Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Benzoates Market Dynamics

Driver: Growth in demand of personal care and home care products

A wide range of cosmetics and personal care items, such as baby products, soaps and detergents, bath products, cleansing products, eye makeup, as well as nail, hair, and skin care items, use benzoate as an ingredient. Preservatives are required in cosmetics and hair care products to prevent the growth of microorganisms. Along with the US, Europe has one of the largest markets for cosmetic products globally, with market size of around USD 94.6 billion in 2021. Apart from preservatives, benzoates are used as aversive additives. In order to discourage oral consumption, home care products, including window cleaners, antiseptics, and laundry detergent, contain a small amount of benzoate. Thus, the growing demand of personal care and home care products is driving the benzoates market.

Restraints: Regulations to limit use of benzoates in packaged food items & beverages

There are numerous concerns regarding the harmful effects on human health caused by the excess consumption of benzoates. Formulation and implementation of various regulations limiting the quantity of benzoates in foods items & beverages have led to uncertainties among manufacturers of benzoates, who need guidance regarding the regulations related to the use of benzoates in food items & beverages. The legal limits and regulations for benzoates as a food preservative vary from country to country, depending upon the weather and environmental conditions. Hence, such limitations and regulations restrain the market growth for benzoates.

Opportunity: Use of benzoates in animal nutrition

Due to the harmful impact of conventional feed additives on animal growth and health, there has been a demand for safe and effective feed additives, which not only result into faster animal growth but also ensures the good health of animals. Benzoate has been discovered to be effective in animal feed and has an anti-diarrhea effect in animal breeding. Additionally, when treating diseased animals, adding benzoate to their diets can considerably increase appetite and boost productivity. Hence, the use of benzoates in animal nutrition provides growth opportunity for the market.

Challenge: Expected increase in usage of natural preservative in food & beverage market may impact the benzoates market

Benzoates are widely used as a preservative. However, the growing awareness on the use of synthetic food additives and their side effects is posing a challenge to the benzoates market. The demand of foods with natural ingredients are increasing, globally. The food industry is considering plant-based alternatives to prevent the growth of germs and rotting. Thus, the shift of consumer preference towards natural additives in food items is favoring the growth of natural food additives market, which can disrupt the benzoate market.

Based on type, sodium benzoate segment is the largest market during the forecast period

The sodium benzoate segment accounted for the largest share in 2021 in terms of value. Food spoilage is prevented by sodium benzoate, which prevents the growth of bacteria, mold, and other germs. It works well with acidic foods and hence is generally used in pickles, soda, jelly, soy sauce, bottled lemon juice, salad dressing. Thus, the growing usage of sodium benzoate in food & beverage along with a wide range of other application is expected to enhance the demand for the segment.

Based on end-use, food & beverage segment is the largest market during the forecast period

The food & beverage segment accounted for the largest share, by end-use during the forecast period, in terms of value. Due to the growing population, there is a significant increase in the demand for food & beverage. Global market of food & beverage is expected to increase significantly from 2021 to 2025. There is also increasing demand for ready to eat food in countries such as China and India due to changing lifestyle majorly in urban areas. Benzoates help to increase the shelf life of food products and beverages. Thus, growth in food industry will enhance the demand for food preservatives, creating the market for benzoates.

Asia Pacific is the largest benzoates market in terms of value

Asia Pacific is the largest benzoates market followed by North America, in terms of value, in 2021. The major economies of the Asia Pacific region contributing significantly to the growth of the benzoates market are China, Japan, India, and South Korea. The region has emerged as an important consumer of benzoates due to the increasing demand from food & beverage industry, aided by rise in the standard of living of the people and disposable income. This further increases the growth of benzoates market in Asia Pacific.

Source: Secondary Research, Expert Interviews, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Major companies in the benzoates market include LANXESS (Germany), Wuhan Youji Industries Co., Ltd. (China), Tengzhou Tenglong Chemical Co., Ltd. (China), Eastman Chemical Company (US), A.M Food Chemical Co., Limited (China), FBC Industries (US), Ganesh Benzoplast Limited (India), among others. A total of 21 major players have been covered. These players have adopted partnerships, acquisitions, and expansions as the major strategies to consolidate their position in the market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market Size Available for Years |

2018-2027 |

|

Base Year Considered |

2021 |

|

Forecast Period |

2022-2027 |

|

Forecast Units |

Value (USD Million) |

|

Segments Covered |

Type, End-use, and Region |

|

Geographies Covered |

Asia Pacific, Europe, North America, Rest of the World |

|

Companies Covered |

The major market players include LANXESS (Germany), Wuhan Youji Industries Co., Ltd. (China), Tengzhou Tenglong Chemical Co., Ltd. (China), Eastman Chemical Company (US), Vertellus (US), Spectrum Chemical Mfg. Corp. (US), Merck KGaA (Germany), Tokyo Chemical Industry Co., Ltd. (Japan), Ganesh Benzoplast Limited (India), among others. |

This research report categorizes the Benzoates market based on Type, End-use, and Region.

Based on type, the benzoates market has been segmented as follows:

- Potassium Benzoate

- Sodium Benzoate

- Ammonium Benzoate

- Others

Based on end-use, the benzoates market has been segmented as follows:

- Food & Beverage

- Pharmaceutical

- Personal Care

- Others

Based on Region, the benzoates market has been segmented as follows:

- Asia Pacific

- Europe

- North America

- Rest of the World

Recent Developments

- In January 2022, Wuhan Youji Industries Co., Ltd. announced the completion of its Wuhan production plant expansion and commencement of production in January. The plant is mainly designed to produce feed-grade benzoic acid products.

- In August 2021, LANXESS completed the acquisition of Emerald Kalama Chemical. The acquisition enabled LANXESS to significantly expand its portfolio of preservatives. Key products for the food industry include sodium and potassium benzoate under the Kalama, Purox and Kalaguard brands.

- In April 2021, Eastman Chemical Company acquired 3F Feed & Food, a European pioneer in the technological and commercial advancement of additives for animal feed and human food.

Frequently Asked Questions (FAQ):

What is the current size of the global benzoates market?

The global benzoates market is projected to grow from USD 429 million in 2022 to USD 540 million by 2027, at a CAGR of 4.7% during the forecast period.

Who are the leading players in the global benzoates market?

Some of the key players operating in the benzoates market are LANXESS (Germany), Wuhan Youji Industries Co., Ltd. (China), Tengzhou Tenglong Chemical Co., Ltd. (China), Eastman Chemical Company (US), Vertellus (US), Spectrum Chemical Mfg. Corp. (US), A.M Food Chemical Co., Limited (China), Tengzhou Aolong Chemical Co., Ltd. (China), Macco Organiques Inc. (Canada), Tokyo Chemical Industry Co., Ltd. (Japan), among others.

Which is the largest segment, by type, in the global benzoates market?

Sodium benzoate, by type, is the largest segment in the global benzoates market. Sodium benzoate is majorly used as a preservative in the food & beverage industry.

Which is the largest segment, by end-use, in the global benzoates market?

Food & beverage, by end-use, is the largest segment in the global benzoates market. The growth in population, aided with the increasing consumption of packaged foods is expected to drive the market for benzoates in food & beverage industry.

Which is the largest region in the global benzoates market?

Asia Pacific, by region, is the largest benzoates market. The major economies of the Asia Pacific region contributing significantly to the growth of the benzoates market are China, India, Japan, and South Korea. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

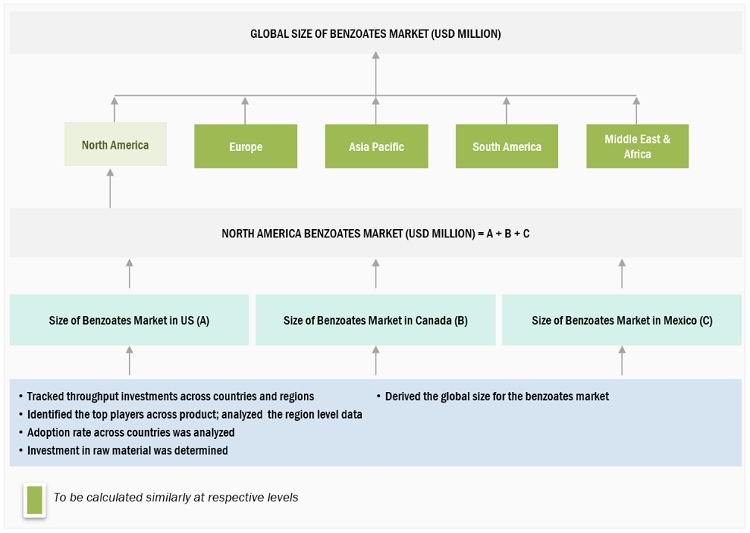

The study involved four major activities in estimating the current size of the benzoates market. Exhaustive secondary research was done to collect information on the market, peer markets, and parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the benzoates value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources for this research study include annual reports; press releases, and investor presentations of companies; white papers; certified publications; and articles by recognized authors, gold- and silver-standard websites, benzoates manufacturing companies, regulatory bodies, trade directories, and databases. The secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and regional markets. It has also been used to obtain information about key developments from a market-oriented perspective.

Primary Research

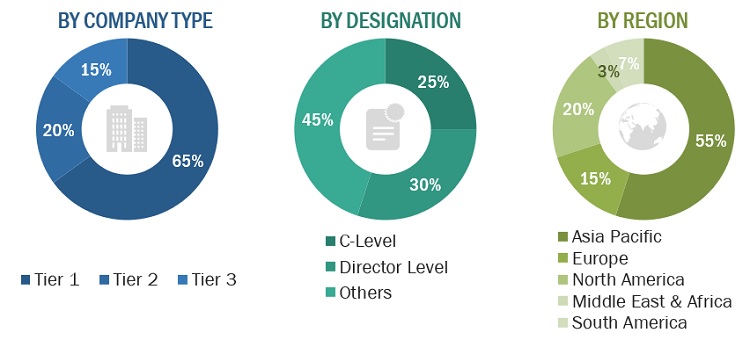

The benzoates market comprises several stakeholders, such as raw material suppliers, processors, end-use industries, and regulatory organizations in the supply chain. The demand side of the market is characterized by the presence of benzoates manufacturers, importers/exporters, and manufacturers engaged in the production of various products. The supply side is characterized by key technology providers for benzoates, end-users, researchers, and service providers.

In the primary research process, various primary sources from the supply and demand sides of the market have been interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side included key opinion leaders, executives, vice presidents, and CEOs of manufacturing companies. The primary sources from the supply side included research institutions involved in R&D activities to introduce new technologies, key opinion leaders, distributors, and benzoates manufacturing companies.

Breakdown of the Primary Interviews

Notes: Other designations include sales managers, engineers, and regional managers.

Tier 1 company—revenue >USD 5 billion, tier 2 company—revenue between USD 1 billion and USD 5 billion, and tier 3 company—revenue

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches have been used to estimate and validate the total size of the benzoates market. These approaches have also been used extensively to estimate the size of various dependent subsegments of the market. The research methodology used to estimate the market size included the following:

The following segments provide details about the overall market size estimation process employed in this study

- The key players in the market were identified through secondary research.

- The market shares in the respective regions were identified through primary and secondary research.

- The value chain and market size of the benzoates market, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of annual and financial reports of the top market players and interviews with industry experts, such as CEOs, VPs, directors, sales managers, and marketing executives, for key insights, both quantitative and qualitative.

Global Benzoates Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the estimation process explained below, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market was validated using both the top-down and bottom-up approaches.

Report Objectives

Market Intelligence

- To analyze and forecast the size of the benzoates market in terms of value

- To define, describe, and forecast the market size by type, end-use, and region

- To forecast the market size with respect to four main regions, namely, Asia Pacific, Europe, North America, Rest of the World

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze the market segments with respect to individual growth trends, prospects, and their contribution to the market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To analyze competitive developments, such as acquisitions, partnerships, and expansions in the benzoates market

Competitive Intelligence

- To identify and profile the key players in the benzoates market

- To determine the top players offering various products in the benzoates market

- To provide a comparative analysis of the market leaders based on the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- To understand the competitive landscape of the market and identify the key growth strategies adopted by the leading players across key regions

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Benzoates Market